How Long Does It Really Take to Buy a House?

You’ve scrimped and saved, deliberated and discussed,

researched and read, and finally decide to buy a home. Congrats! Even being

ready and able to buy a home is a big achievement. But even with all the time

and effort you put into this monumental decision, you might still have some

lingering questions, especially if this is your first foray into the realm of

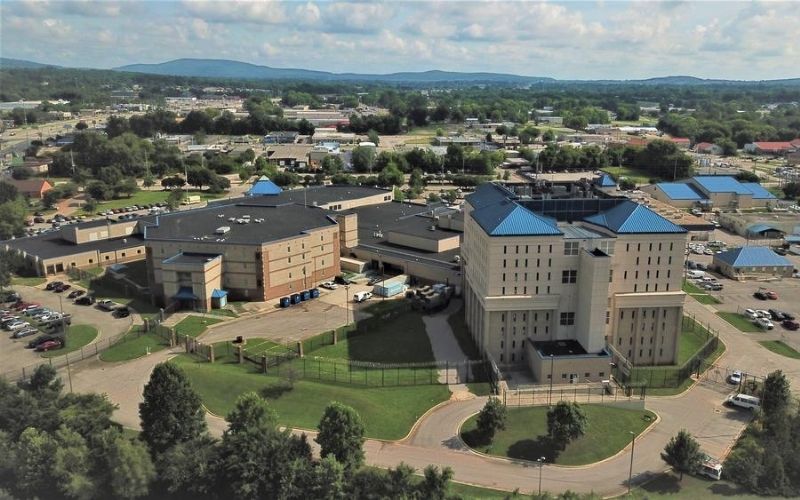

real estate. LiveInAlabama.com is your local source for a local real estate

agent that can answer most of them, but one that’s on everyone’s mind when they

first start the homebuying process, but they’re sometimes too shy to ask: how

long does it even take to buy a house?

While this is a valid and important question to examine,

it’s also, unfortunately, one with no clear-cut answer. According to homes.com, homebuyers spend an average of “30-60 days

shopping and 14-60 days from contract to close,” then have another 14-45 days

before their first mortgage payment is due. That comes to a total of 61 days on

the low end and a whopping 165 days, or about five and a half months, on the

upper end...quite a spectrum!

So, why does buying a home take some people almost three

times as long as it does others? That depends on various fluctuating factors,

like the wants, needs, and motivation of both the buyer and seller, the overall

housing market, and the involvement of banks and other financial institutions.

Like the housing market and the seller’s wants and wishes, some of these are

beyond the buyer’s control. However, some steps can be taken to speed up the

process and get you into your dream home sooner rather than later.

The first way to expedite the home buying process is to do

your homework! Start looking online and going to open houses in the area where

you’d like to buy to get a sense of price point and demand. Plus, open houses

are perfect for making an IRL connection with the thousands of agents in the LiveInAlabama.com Agent Directory. Another great way to get hustlin’ to your new home

is to come to a consensus on your family’s lists of wants and needs, including

a (rough) timeline. For example, how many bedrooms? Which school district? Is a

garage necessary? And do you need to be settled before school or a new job

starts? Figuring out these details will help your real estate agent help you by

showing you only homes that meet your exact criteria, which speeds up the

homebuying process.

The most important homework assignment, though, involves a

little more effort...not to mention a lot more paperwork. Getting pre-approved

for a mortgage is the most significant step you can take to hasten the home

buying process, as it gives you a solid budget to work within, as well as

highlighting to sellers that you’re a serious buyer. But don’t take that as a

cue to rush into anything. Instead, try visiting several banks or lending

institutions to give yourself a sense of what you qualify for, including

homebuyer programs. This is where the paperwork comes in—usually, they’ll want

to see documents like recent pay stubs, tax returns, and a few months of bank

statements.

Home is where the heart is, so get there ASAP with a

little help from LiveInAlabama.com. Greater Alabama Multiple

Listing Service. With

thousands of agents, you’re sure to find your family’s perfect fit!